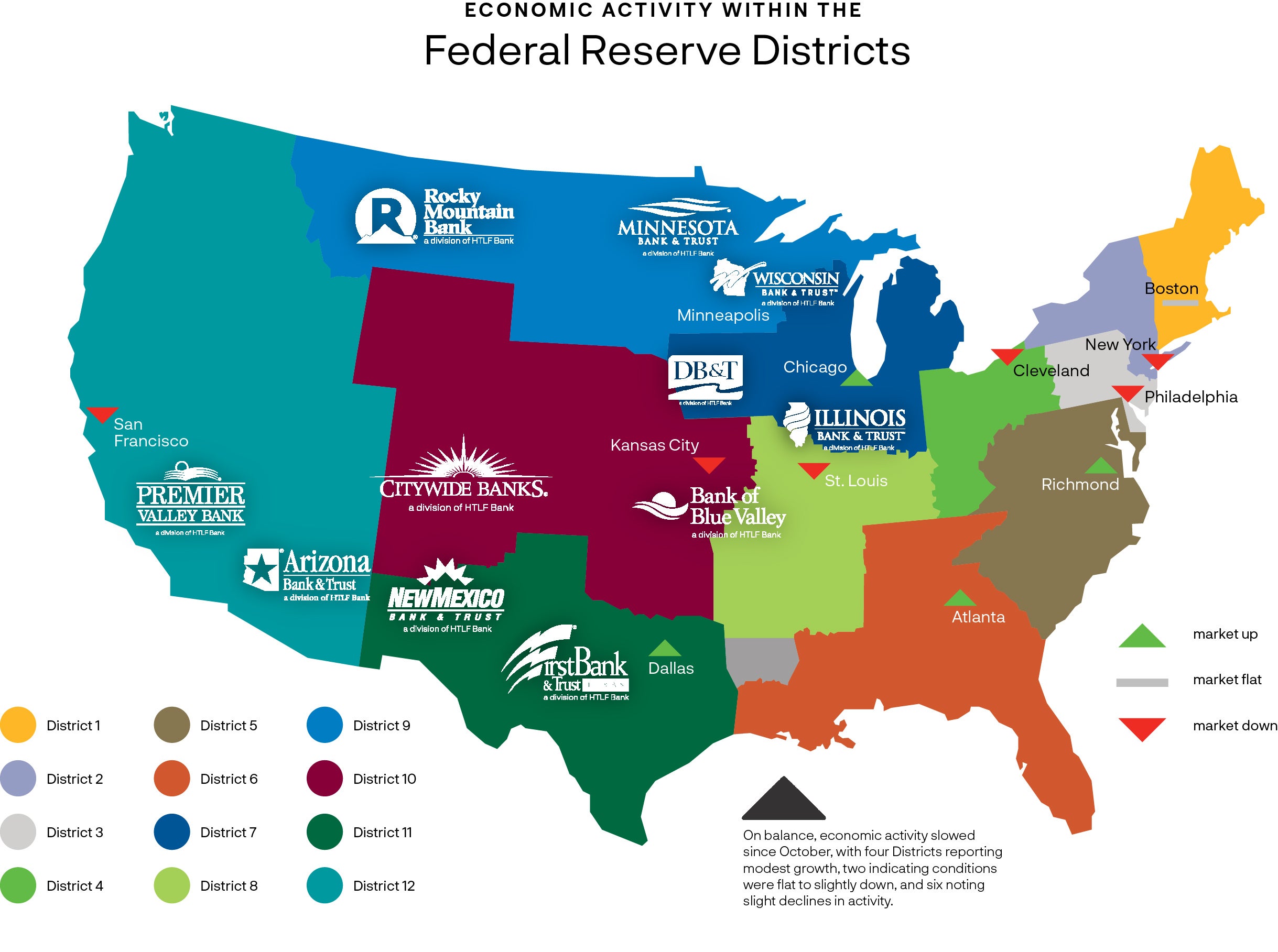

Commonly known as the Beige Book, this report is published eight times per year. Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts and other sources. The Beige Book summarizes this information by District and sector. An overall summary of the twelve district reports is prepared by a designated Federal Reserve Bank on a rotating basis.

Overall Economic Activity

Retail sales, including autos, remained mixed; sales of discretionary items and durable goods, like furniture and appliances, declined, on average, as consumers showed more price sensitivity. Travel and tourism activity was generally healthy. Demand for transportation services was sluggish. Manufacturing activity was mixed, and manufacturers’ outlooks weakened. Demand for business loans decreased slightly, particularly real estate loans. Consumer credit remained fairly healthy, but some banks noted a slight uptick in consumer delinquencies. Agriculture conditions were steady to slightly up as farmers reported higher selling prices; yields were mixed. Commercial real estate activity continued to slow; the office segment remained weak and multifamily activity softened. Several Districts noted a slight decrease in residential sales and higher inventories of available homes. The economic outlook for the next six to twelve months diminished over the reporting period.

Labor Markets

Demand for labor continued to ease, as most Districts reported flat to modest increases in overall employment. The majority of Districts reported that more applicants were available, and several noted that retention improved as well. Reductions in headcounts through layoffs or attrition were reported, and some employers felt comfortable letting go low performers. However, several Districts continued to describe labor markets as tight with skilled workers in short supply. Wage growth remained modest to moderate in most Districts, as many described easing in wage pressures and several reported declines in starting wages. Some wage pressures did persist, however, and there were some reports of continued difficulty attracting and retaining high performers and workers with specialized skills.

Prices

Price increases largely moderated across Districts, though prices remained elevated. Freight and shipping costs decreased for many, while the cost of various food products increased. Several noted that costs for construction inputs like steel and lumber had stabilized or even declined. Rising utilities and insurance costs were notable across Districts. Pricing power varied, with services providers finding it easier to pass through increases than manufacturers. Two Districts cited increased cost of debt as an impediment to business growth. Most Districts expect moderate price increases to continue into next year.

Outlook Across the 12th District

Twelfth District economic activity softened slightly during the October to mid-November reporting period. Labor market tightness eased moderately, and employment levels remained generally steady. Wages and prices rose at a slower pace relative to the previous reporting period. Retail sales were flat, and activity in the services sectors picked up slightly. Demand for manufactured products remained largely unchanged, while conditions in agriculture and resource-related sectors were mixed. Residential real estate activity softened, while activity in commercial real estate was varied. Conditions in the financial sector weakened further, and lending standards remained tight. Communities across the Twelfth District saw continued high demand for support services that was harder to meet due to declining charitable donations. Contacts expressed concern over a weaker economic outlook and increased overall uncertainty.

Labor Markets

Labor market tightness continued to ease over the reporting period. Many employers reported improved availability and retention of workers in recent weeks as well as an uptick in job applications. Some employers, citing an uncertainty over the economic outlook, held staffing levels steady and only filled positions that opened up due to turnover. Employers in industries, such as legal services and aerospace, expanded their workforce in recent weeks, while some in manufacturing and financial services reported reductions in staffing. Nevertheless, employee turnover was reportedly elevated in hospitality and manufacturing. Several contacts expected the recent tentative agreement surrounding strike actions in the entertainment industry will bring back a significant number of workers in coming months.

Wage growth moderated across sectors as imbalances in labor market conditions for supply and demand continued to improve. Contacts reported budgeting annual pay raises in line with pre-pandemic rates. Recent layoffs in the financial services sector reportedly put downward pressure on wages within the sector. Wage pressures remained high for employers in legal services and some high-skilled trades across sectors. Some contacts highlighted upward wage pressures from the increases in minimum wages happening locally and ongoing labor union negotiations.

Prices

Prices remained elevated but rose at a slower pace relative to the previous reporting period. The recent drop in energy prices and signs of potential tapering overall demand growth helped alleviate some price pressures in recent weeks. Several contacts reportedly reduced fees for professional services in response to lower demand. Still, material and insurance costs continued to rise. In some instances, these costs were passed on to consumers, although one contact observed some pushback from customers to higher menu prices. Real estate firms noted that higher input, building and loan costs adversely impacted new construction projects.

Retail Trade and Services

Retail sales were flat overall in recent weeks. Reports suggested some pullback in consumer spending on big-ticket items, such as motor vehicles. Demand was stronger for some product categories, such as groceries, fresh produce, and seafood. Retailers expected a solid holiday shopping season but noted that more discounts and offers than last year will be needed to entice consumers.

Activity in consumer and business services picked up slightly. Demand for leisure travel increased in recent weeks and was expected to rise further for the holiday season. Business demand for information technology, custodial, and security services increased, while demand for consulting services was down. Several contacts expected the end of strike actions in the entertainment industry to spur growth in the Southern California economy, although some feared that many local businesses and services providers would be unable to recover losses for an extended period.

Manufacturing

Manufacturing activity was unchanged at robust levels in recent weeks. Manufacturers reported continued general strength in the sector and solid demand for heavy machinery, capital equipment and fabricated metal products. The aerospace industry reportedly saw an uptick in orders in recent weeks. Food manufacturing and packaging continued to operate at or near capacity. Reports indicated continued improvements in raw materials availability and supply chains, although some manufacturers mentioned lingering delivery delays.

Agriculture And Resource-Related Industries

Conditions in the agriculture and resource-related sectors were mixed. Across the District, crop yields were generally at or above historical averages, particularly for apples. Domestic demand from the food services and retail sectors was solid but showed some signs of easing in recent weeks, and exports for some products such as nuts rose. Producers commanded lower prices for products such as fish and nuts and expected apple prices to fall due to the strong harvest. Costs for fuel, packaging, labor and equipment rose, while irrigation and international shipping costs declined. One contact in Utah cited notable reductions in the cost of feeding livestock as ample growth of grasses on grazing lands lowered demand and prices for hay.

Commercial real estate activity was varied in recent weeks. Office leasing activity was muted, and occupancy rates remained low. In contrast, demand for space in sectors less conducive to remote work, such as defense and lab-based sciences, was robust and occupancy rates were high. Elevated financing costs and economic uncertainty slowed commercial construction projects. A contact in Utah reported that construction continued as planned on existing industrial projects, but that rent growth in this sector began to ease.

Get Your Financial Feed Today

The Financial Feed is the premiere publication for banking insights. Each issue prioritizes strategies on how business leaders can continue to grow despite possible economic headwinds. We hope these findings help you conquer potential challenges and capitalize on opportunities.

Source: The Federal Reserve’s Beige Book

These links are being provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by HTLF of any of the products, services or opinions of the corporation or organization or individual. HTLF bears no responsibility for the accuracy, legality or content of the external site or for that of the subsequent links. Contact the external site for answers to questions regarding its content and privacy rules.